Section 8 Microfinance Company Registration - Online Process, Documents Required, Cost

Section 8 Microfinance Company or Micro-finance Institution (MFI) is a financial organisation that provides credit to people and organisations who are denied access to traditional financial institutions due to poverty, occupation, ethnicity, religion, or nationality.

Incorporation of a Microfinance Company under Section 8 is the establishment of a non-profit microfinance organization in India under Section 8 of the Companies Act, 2013. These organizations play a crucial role in offering financial services to low-income persons and marginalized communities, to empower them economically. The microfinance company registration process will fully comply with the legal requirements and regulatory standards of the Ministry of Corporate Affairs (MCA) and other relevant authorities.

By providing crucial financial services, including microloans, savings, and insurance coverage, the Section 8 Microfinance Companies are major players in ensuring financial inclusion and improving the socio-economic status of the underserved population of India. To start a Microfinance Company requires careful planning strict adherence to legal and regulatory requirements, and a commitment to serving the financial needs of underserved communities with an agenda for social impact and sustainability should be at the core. It also enhances the credibility of the microfinance sector.

What is a Section 8 Microfinance Company?

Section 8 Microfinance companies are financial organisations that provide finances to low-income groups. These companies are introduced to ease the credit system for small businesses as they don't get loan facilities from banks due to their complex process.

Therefore, it is also known as a Micro-credit or Micro-benefit organisation. Microfinance companies are the most convenient business to register that can provide unsecured loans without RBI approval at rates upto 26% p.a.

The compliances of section 8 company as a Microfinance business is same as normal with an addition of filing of MBP-1.

Definition of Microfinance Loan

- A microfinance loan is defined as a collateral-free loan given to a household having annual household income up to ?3,00,000. For this purpose, the household shall mean an individual family unit, i.e., husband, wife and their unmarried children.

- All collateral-free loans, irrespective of end use and mode of application/ processing/ disbursal (either through physical or digital channels), provided to low-income households, i.e., households having annual income up to ?3,00,000, shall be considered as microfinance loans.

- To ensure collateral-free nature of the microfinance loan, the loan shall not be linked with a lien on the deposit account of the borrower.

- The REs shall have a board-approved policy to provide the flexibility of repayment periodicity on microfinance loans as per borrowers’ requirement.

Benefits of Section 8 Microfinance Company

No RBI Approval required

- Can lend Unsecured loan

- No Demographic Barrier

- Best Rate of Interest

- Minimum capital not required

- Defaulters can be sued for non-payment

- Limited Compliances

Documents required for Section 8 Microfinance Company

-

-

-

-

-

-

-

-

-

-

- PAN & Aadhar Card of both the directors

- Bank Statement with the address of both the directors (not older than 2 months)

- Passport Size Photo

- Email address & Phone number

- Utility Bill of the premises

-

-

-

-

-

-

-

-

-

Process of Section 8 Microfinance Company registration

Step 1: Obtain Digital Signature Certificate (DSC)

To form a company, you must apply for the digital signature certificate of the designated directors of the proposed company. All the documents for Section 8 companies are filed online, and e-forms must be digitally signed. So, the designated directors must obtain their DSCs from certifying agencies.

Step 2: Apply for Name Approval

The next step is to apply for name approval. The name must suggest that it is registered as a Section 8 company. While making the name application of the company, the industrial activity code and object clause of the company have to be defined.

Step 3: File SPICe Form (INC-32)

After the name approval, details concerning the company's registration have to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. The details in the form are as follows

Step 4: File MoA and AoA with “Finance” Objective

SPICe e-MoA and e-AoA are the linked forms to be drafted when applying for company registration.

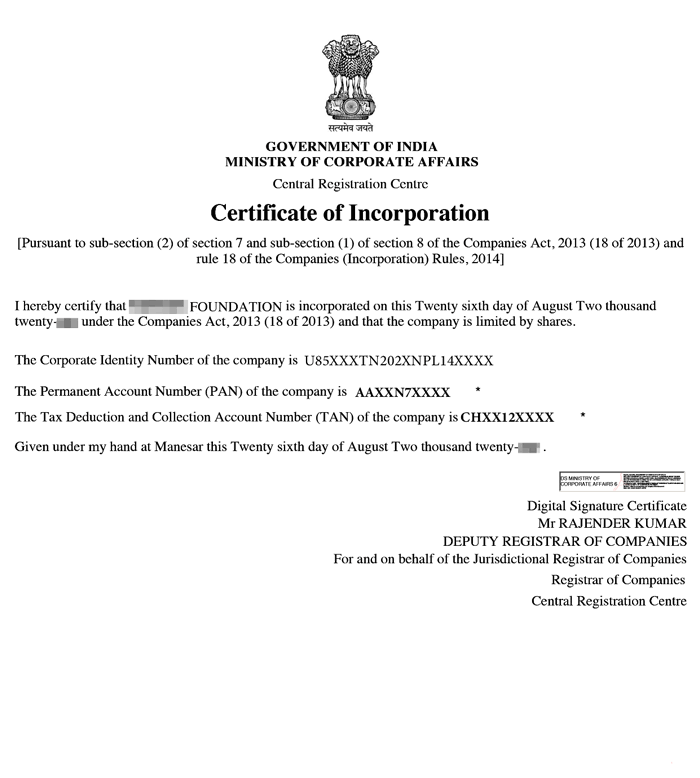

Step 5: Issuance of Incorporation Certificate

Post-approval of the documents from the Ministry of Corporate Affairs, PAN, TAN & Certificate of Incorporation will be issued from the concerned department.

Section 8 MicroFinance Company Registration Fee

The total cost of registering a micro-credit/finance company under section 8 registration with professional Utiltites is Rs. 50,000 only all-inclusive.

All applicable taxes are included in the approximately that must be paid as part of the registration fee for a section 8 microfinance company.

Note: The aforementioned Fees is exclusive of GST.

Register your Section 8 Company in India with Monitrix

Step 1: Get in touch via call contact form

Step 2: Provide necessary documents

Step 3: Get your incorporation registered in 10-14 days

Conclusion

Starting up your own Section 8 Microfinance company can be an extremely rewarding experience, allowing you to help people improve their lives through the small business loans you make available to them.

The registration process is extremely simple and hassle-free if you choose the right Business consultant to help you with it. However, it can also be quite daunting, as getting your Microfinance Company incorporated as a Section 8 Company isn’t always the easiest thing. Luckily, it does not have to be difficult if you follow the right steps.

.svg)