Public Ltd Company Registration in India - Online Process, Documents Required, Fees

A Public Limited Company has the benefits of limited liabilities and it can sell its shares to the general public for raising capital. It is suitable for large businesses that require huge capital and registered under Companies Act, 2013. Public limited companies can list themselves in the stock market and offer shares to the general public in the form of Initial Public Offerings (IPO). Get to know the benefits, process and requirements of Public Limited Company registration.

What is a Public Limited Company?

A Public Limited Company is a type business entity which has limited liability features and offers shares to the general public for raising equity capital. It is governed by Companies Act, 2013 and registered under the Ministry of Corporate Affairs. It can be incorporated with a minimum number of seven members and at least three members must be the directors of the company.

Advantages of Public Limited Company registration

Limited Liability:

It helps in protecting personal assets of the owners with limited liability protection. So if there are any financial issues with the company, the assets of the director are secured and could not be seized by banks or departments.

Separate Legal Entity:

A public limited company is a separate legal entity in its own right and hence the business owners aren’t subject to any personal liability. The company can acquire assets and incur debts on its own name.

Raise Capital:

Public Limited Company can raise funds by offering shares to the general public and hence it can raise more capital easily.

Credibility and Attention:

As listed on the stock market, a public limited company has higher credibility than other limited companies.

Free Transferability of Shares:

Unlike Private Limited Company where the shares can only be transferred with the consent of other members of the company, a public limited company can easily transfer the shares freely.

Minimum requirements for Public Limited Company registration

- Minimum of seven members are required

- Minimum of 5 lakh rupees is required for share capital

- At least three members must be the directors of the company

Process of Public Limited Company registration

Step 1. Application for Digital Signature Certificate (DSC)

Public Limited Company registration is a complete digital process and therefore requirement of Digital Signature Certificate is a mandatory criteria. Directors as well as subscribers to the memorandum of the company need to apply for a DSC from the certified agencies. Obtaining a DSC is a complete online process and it can be done within 24 hours. This process involves 3 simple verifications that are document verification, video verification and phone verification.

Step 2. Application for the Name Approval

Name application for Public Limited Company can be done through SPICe RUN form which is a part of SPICe+ form. While making the name application of the company, industrial activity code as well as object clause of the company has to be defined.

Note: It should be ensured that business name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950). You can easily check the name availability by using our company name search tool to verify the same.

Step 3. Filing of SPICe Form (INC-32)

Post name approval, details with respect to registration of the company has to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. The details in the form are as follows:

- Details of the company

- Details of members and subscribers

- Application for Director Identification Number (DIN)

- Application for PAN and TAN

- Declaration by directors and subscribers

- Declaration & certification by professional

Step 4. Filing of e-MoA (INC-33) and e-AoA (INC-34)

SPICe e-MoA and e-AoA are the linked forms which have to be drafted at the time of application for company registration.

Memorandum of Association (MOA) is defined under section 2(56) of the Companies Act 2013. It is the foundation on which the company is built. It defines the constitution, powers and objects of the company.

The Articles of Association (AOA) is defined under section 2(5) of the Companies Act. It details all the rules and regulations relating to the management of the company.

Step 5. Issuance of PAN, TAN and Incorporation Certificate

Post approval of the above mentioned documents from the Ministry of Corporate Affairs; PAN, TAN & Certificate of Incorporation will be issued from the concerned department. Now, the company is required to open a current bank account by using these documents. You can contact us for assistance with your current bank account opening.

Documents required for Public Limited Company registration

As per the Companies Act 2013, you need to provide proper identity proof of members and directors along with valid address proof of the business office. It is important to note that you don't need to own a commercial property for company registration; one can use his residential address for incorporation of the company. Here are the documents required:

- Passport size photographs of the members

- Copy of PAN Card of the members

- Copy of Aadhar Card or Voter ID

- Bank statement (not older than two months)

- Proof of registered place of business

- No Objection Certificate from the owner of the property

Documents you’ll get post incorporation

Post incorporation of Public Limited Company, you’ll receive the following documents:

- Certificate of Incorporation

- Permanent Account Number (PAN) of the company

- Tax Deduction or Collection Account Number (TAN) of the company

- Memorandum of Association (MoA)

- Director Identification Number (DIN)

- Digital Signature Certificate (DSC)

- EPF and ESIC registration documents

- Company Master data

Public Limited Company Registration Fees

The total cost of Public Limited Company registration in India, including government and professional fees, starts from 16,699 and takes around 14-21 working days.

| Steps | Cost (Rs.) |

| Digital Signature Certificate | 7,000 |

| Government Fee | 1,800 |

| Professional Fee | 3,199 |

| Total Cost | 16,699* |

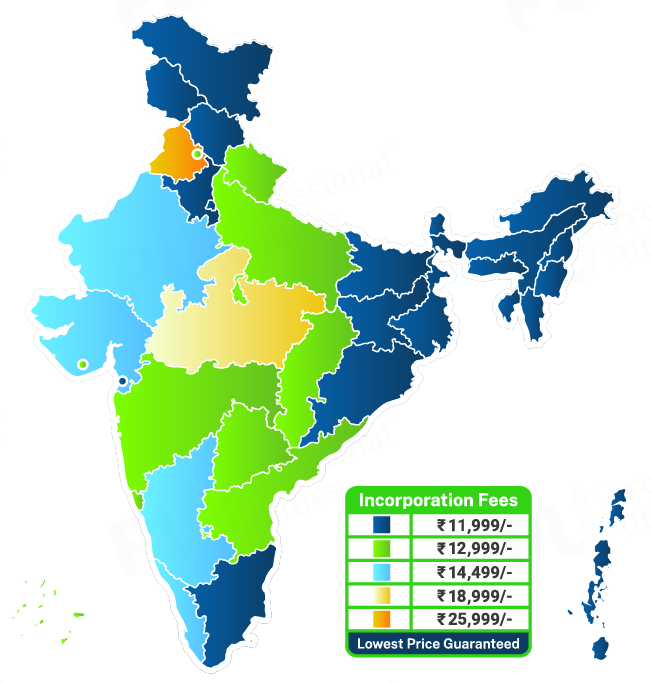

*Important Note: The total incorporation fees of a Public Ltd Company varies from state to state. Refer to the map for state-wise prices.

Time required for registration of Public Limited Company

On average, it takes around 14-21 working days to register a Public Limited company in India subject to document verification by the Ministry of Corporate Affairs (MCA).